Updated March 31, 2025

As a property owner or investor navigating the complex world of cell tower leases, understanding the broader economic landscape is crucial—especially when it comes to interest rates. These rates, set and influenced by central banks like the Federal Reserve, have ripple effects across all sectors of real estate, including telecommunications infrastructure.

But how exactly do interest rates affect cell tower leases? And what should you, as a property owner, be aware of when rates rise or fall?

At Airwave Advisors, we specialize in helping property owners maximize the value of their cell tower leases. In this article, we’ll break down the key ways interest rates impact lease values, negotiations, and buyout offers—so you can make smarter, more profitable decisions.

The Basics: What Are Interest Rates?

Interest rates represent the cost of borrowing money. When interest rates are low, borrowing becomes cheaper, which can fuel investment and expansion. Conversely, high interest rates make borrowing more expensive, which tends to slow down growth and lower asset values.

In the world of finance and real estate, interest rates directly influence:

The discount rates used in valuation models

Cap rates for investment properties

The attractiveness of fixed-income assets like cell tower leases

The cost of capital for wireless carriers and infrastructure companies

Understanding these connections is the first step toward leveraging your lease in any interest rate environment.

Cell Tower Leases as Fixed-Income Assets

From an investment standpoint, a cell tower lease resembles a fixed-income asset. Like a bond or an annuity, it provides a predictable stream of income over time.

When interest rates rise, the value of fixed-income assets typically declines. Why? Because new investments offer higher yields, making older, lower-yielding contracts less attractive. This inverse relationship also applies to cell tower leases.

For example:

If you have a lease generating $30,000 annually, and interest rates rise from 5% to 7%, that lease becomes less valuable to investors using yield-based valuation models.

On the flip side, when interest rates fall, your lease becomes more attractive and potentially more valuable.

Impact on Lease Buyout Offers

One of the most direct ways interest rates affect property owners is through lease buyout offers. Companies like Crown Castle, American Tower, and other lease buyout firms regularly offer lump-sum payments in exchange for future lease revenue.

These offers are calculated using present value formulas that discount future cash flows. The discount rate used in those calculations is closely tied to prevailing interest rates.

When Interest Rates Are Low:

Discount rates are low

Future cash flows are worth more in today’s dollars

Buyout offers tend to be higher

When Interest Rates Are High:

Discount rates are higher

Future cash flows are worth less in today’s dollars

Buyout offers tend to be lower

If you’re considering selling your lease, timing the market based on interest rate trends can significantly impact your payout.

The Effect on Lease Valuations

Let’s say you’re trying to determine the fair market value of your cell tower lease. Whether you’re negotiating with a carrier or considering a buyout, valuation is key.

Valuation firms (including ours at Airwave Advisors) use models that factor in:

Remaining lease term

Rent escalations

Risk of termination

Comparable lease rates

Current interest rates

Even a 1% increase in interest rates can reduce lease valuations by tens of thousands of dollars, depending on the lease’s term and structure.

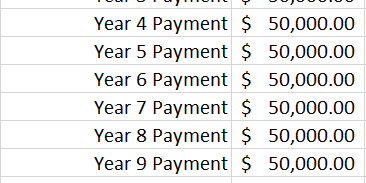

Here’s a simplified example:

| Scenario | Annual Rent | Years Remaining | Discount Rate | Estimated Value |

|---|---|---|---|---|

| Low Rate (5%) | $30,000 | 20 | 5% | $373,896 |

| High Rate (7%) | $30,000 | 20 | 7% | $319,505 |

That’s a $54,000 difference due solely to interest rate changes.

Impact on Carriers and Infrastructure Companies

Interest rates don’t just affect you—they also affect the wireless carriers and tower companies on the other side of the lease.

For Carriers:

Higher interest rates increase the cost of capital.

This may slow network expansion or lead to renegotiation efforts to lower lease costs.

Carriers may prioritize terminating underperforming leases to cut expenses.

For Tower Companies:

Rising rates can suppress stock prices and reduce acquisition activity.

Infrastructure companies may become more selective with buyouts or build-to-suit projects.

They may delay rooftop lease acquisitions or look for lower prices to maintain return thresholds.

If you’re approached by a carrier or tower company with a renegotiation or buyout proposal, it’s crucial to understand their financial motivations—especially in a rising-rate environment.

What Happens During Rate Hikes?

In 2022 and 2023, the U.S. experienced one of the fastest interest rate hikes in decades. The Federal Reserve raised rates to combat inflation, and the effects rippled through the cell tower lease market.

During this time, we observed:

Fewer buyout offers: Some firms paused acquisition activity altogether.

Lower lump-sum offers: Present values were reduced due to higher discount rates.

Increased renegotiation pressure: Carriers sought to reduce rent increases or extend lease terms at lower escalators.

Reduced third-party investor interest: Some institutional buyers moved funds into higher-yielding assets like treasuries or commercial debt.

Property owners who sold leases during low-rate periods (2020–2021) likely received top-dollar valuations. Those who waited may now be facing a more subdued market.

What to Do in a High-Interest Rate Environment

Just because interest rates are high doesn’t mean you can’t make smart moves with your cell tower lease. In fact, high-rate environments can offer strategic advantages—if you know how to navigate them.

Here are a few tips:

1. Hold Rather Than Sell

If lease buyout offers are lower than you’d like, consider holding the lease. You’ll continue to receive predictable income that may still outperform other investments.

2. Negotiate with Leverage

Carriers may seek to renegotiate lease terms to control costs. Use your understanding of interest rate dynamics to push for fair market rent increases, rather than settling for below-market rates.

3. Structure Lease Escalators Wisely

Fixed escalators (like 3% annually) may lose ground to inflation and rising interest rates. Consider incorporating CPI-based adjustments or hybrid escalators to future-proof your income.

4. Work with an Expert

Don’t go it alone. Whether you’re evaluating a buyout, renegotiation, or new lease proposal, partnering with an experienced advisor (like us!) can ensure you don’t leave money on the table.

What to Do in a Low-Interest Rate Environment

When rates are low, leaseholders are in a stronger position. Here’s how to capitalize:

1. Evaluate Selling

If you’ve considered selling your lease, low-rate environments often yield the highest buyout offers. This can be a great time to cash out at peak value.

2. Lock in Long-Term Value

Negotiate long-term lease extensions with strong escalators while market conditions are favorable.

3. Reinvest Proceeds

If you sell your lease, consider reinvesting in diversified assets, including real estate, to hedge against future rate fluctuations.

Planning Ahead: Forecasting Interest Rate Trends

Nobody can predict the future with certainty, but you can monitor key indicators to stay informed:

Federal Reserve Policy: Watch for announcements and interest rate forecasts.

Inflation Trends: Rising inflation often triggers rate hikes.

Bond Market Yields: The 10-year treasury yield is a benchmark for long-term rates.

Housing and Credit Data: Consumer borrowing trends can signal shifts in monetary policy.

By staying informed, you’ll be better equipped to time decisions like lease renegotiations, sales, or hold strategies.

The Bottom Line

Interest rates play a powerful—yet often overlooked—role in the world of cell tower leases. Whether you’re considering a buyout, facing a renegotiation, or simply assessing the value of your lease, understanding the impact of interest rates can help you make more strategic and profitable decisions.

At Airwave Advisors, we help property owners across the country navigate these financial complexities with confidence. We offer:

Expert lease valuation services

Strategic negotiation support

Buyout offer reviews

Industry insights tailored to the current economic climate

Thinking of selling your lease? Not sure how interest rates affect your lease’s value? Let’s talk. We’ll guide you every step of the way so you can maximize the value of your telecom lease.

Contact Airwave Advisors Today

📞 Call us at (888) 443-5101

📧 Email us at [email protected]

Let our experience be your advantage.

Related Articles

About Nick G. Foster

Since founding Airwave Advisors® in 2014, Mr. Foster has added value to over 400 clients ranging from the State of Nevada, City of Beverly Hills, to Habitat For Humanity. Mr. Foster focuses on cell tower lease renewals, buyouts, new lease negotiation, and cell site lease management. Prior to starting Airwave Advisors® Mr. Foster founded and led the Cell Site Services Group within nationwide commercial real estate services leader Cassidy Turley (now known as Cushman & Wakefield).